Need to open a current or savings account? You can do it easily from your Web Banking area, via the mobile app or the website.

From the app:

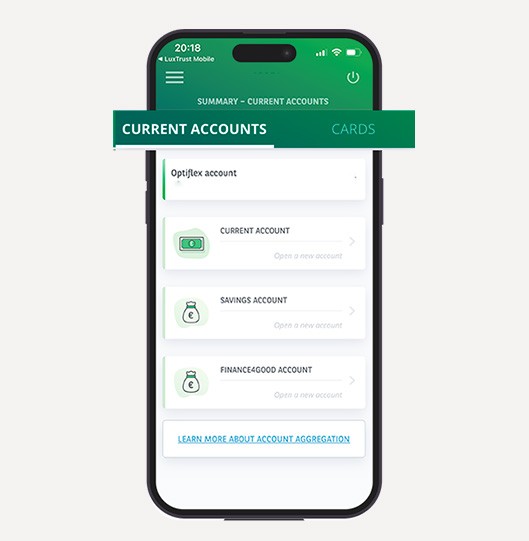

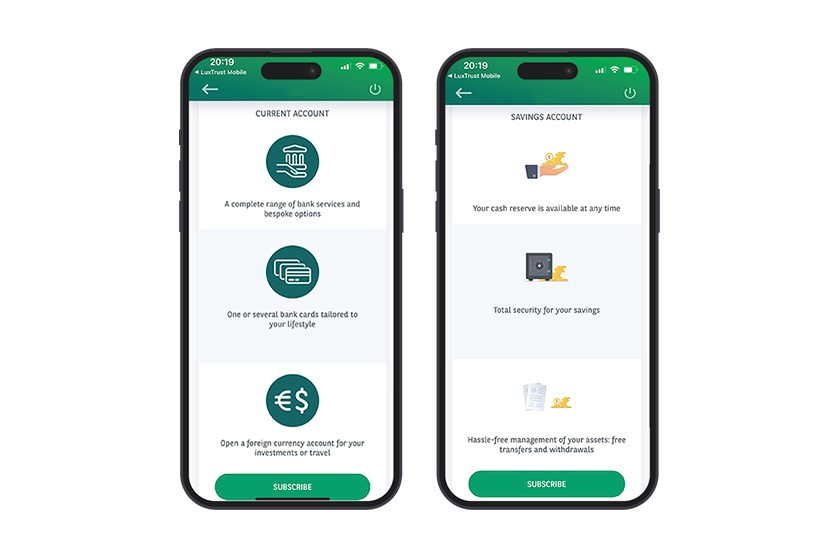

- In the ‘Accounts’ menu, select ‘Current account’ or ‘Savings account’.

- Tap ‘Subscribe’ and choose the currency for the new account.

- Tap ‘Confirm’ and authenticate with your LuxTrust device.

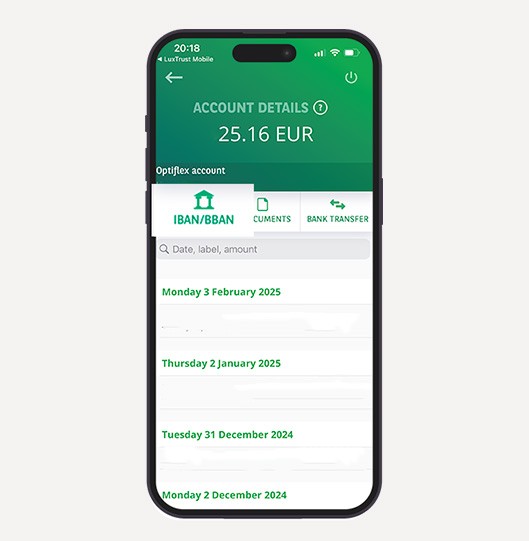

You can also initiate a first transfer, which will be processed as soon as the account is opened.

From the website:

- In the ‘Accounts’ menu, under your current or savings accounts, click ‘Open a new account’ or ‘Open a new savings account’.

- Fill in the subscription form, click ‘Confirm’, and authenticate with your LuxTrust Mobile on your smartphone.