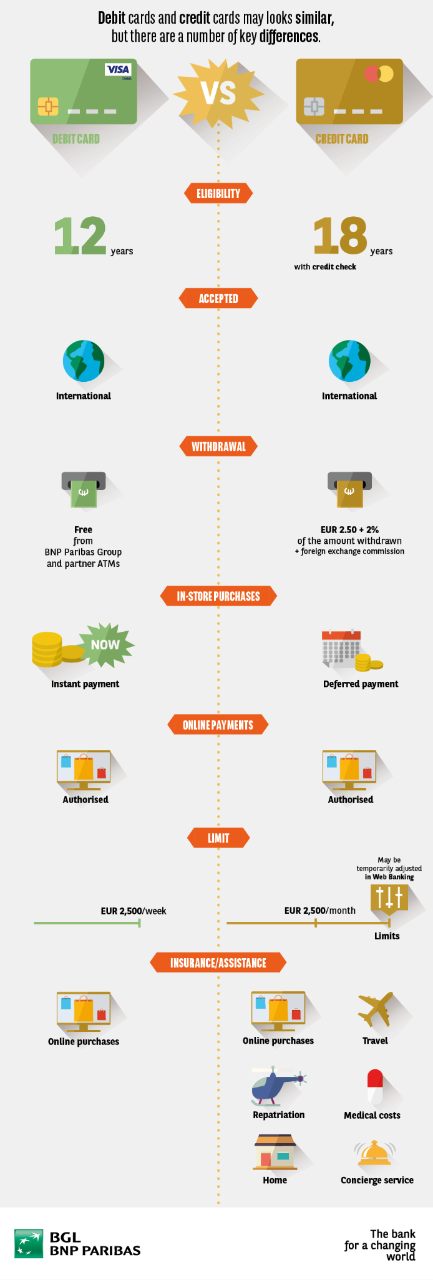

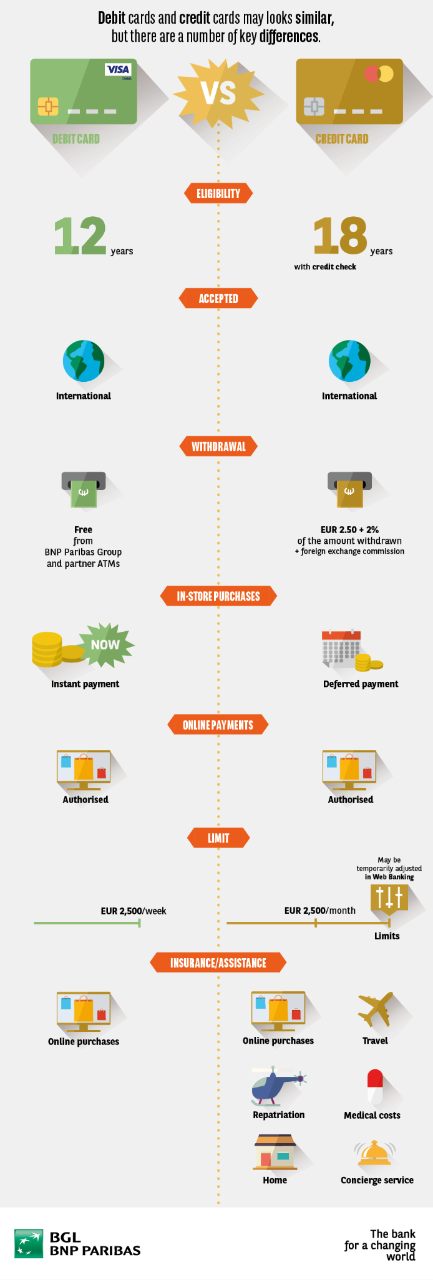

Debit cards versus Credit cards

BGL BNP Paribas’ debit card is a Visa Debit.

BGL BNP Paribas also offers a range of different credit cards. The main difference between these is the services they include.

You can choose between cards:

In Luxembourg, debit cards are available to clients aged 12 and over. They are automatically issued to anyone who holds a current account with BGL BNP Paribas.

Credit cards are available to anyone over the age of 18, based on a creditworthiness check by your bank.

Debit cards and credit cards enabling you to pay for purchases:

Withdrawals made using your debit card are free at all ATMs belonging to:

With a credit card, withdrawals are charged at national rates:

This rate is EUR 2,50 + 2% of the amount withdrawn.

With a debit card, your bank account is immediately charged.

However, credit cards allow you to defer the payment of your purchases.

The (weekly) usage limits for your debit card are:

Subject to an available account balance.

Your credit card limit is defined:

Our Visa Debit card offers you access to online purchase protection insurance, covering:

Our credit cards offer insurance and assistance services for both you and your family.

These services cover, for example: