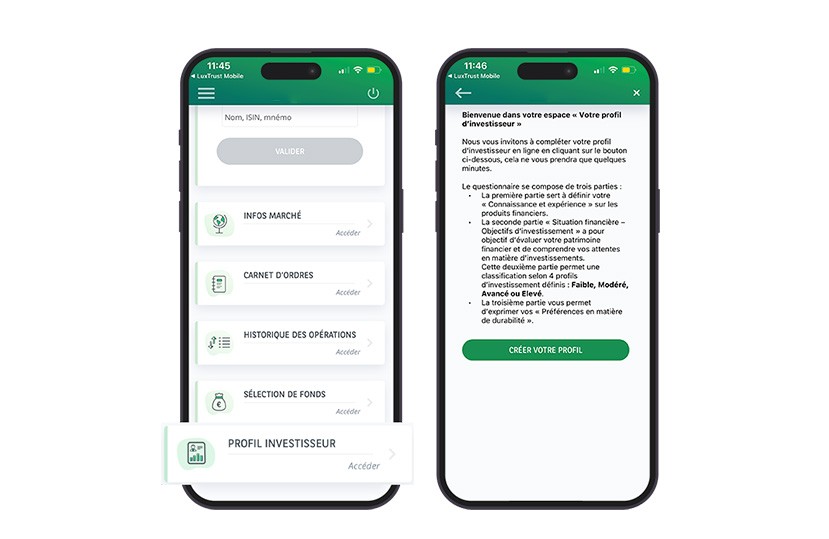

Under the European MiFID directive, whether you are an occasional or regular investor, you must complete a questionnaire before placing your first stock market order.

Self-managed investments:

If you manage your investments yourself under the Direct Invest Access option, you must answer a questionnaire about your knowledge and experience with different types of financial products.

Advisory or discretionary management:

If you choose one of these services, you will need to complete, in addition to the section on your knowledge and experience, a questionnaire covering:

- Your investment objectives

- Your financial capacity

- Your sustainability preferences

At the end of these questionnaires, you will receive your profile result (low, moderate, advanced or high risk).