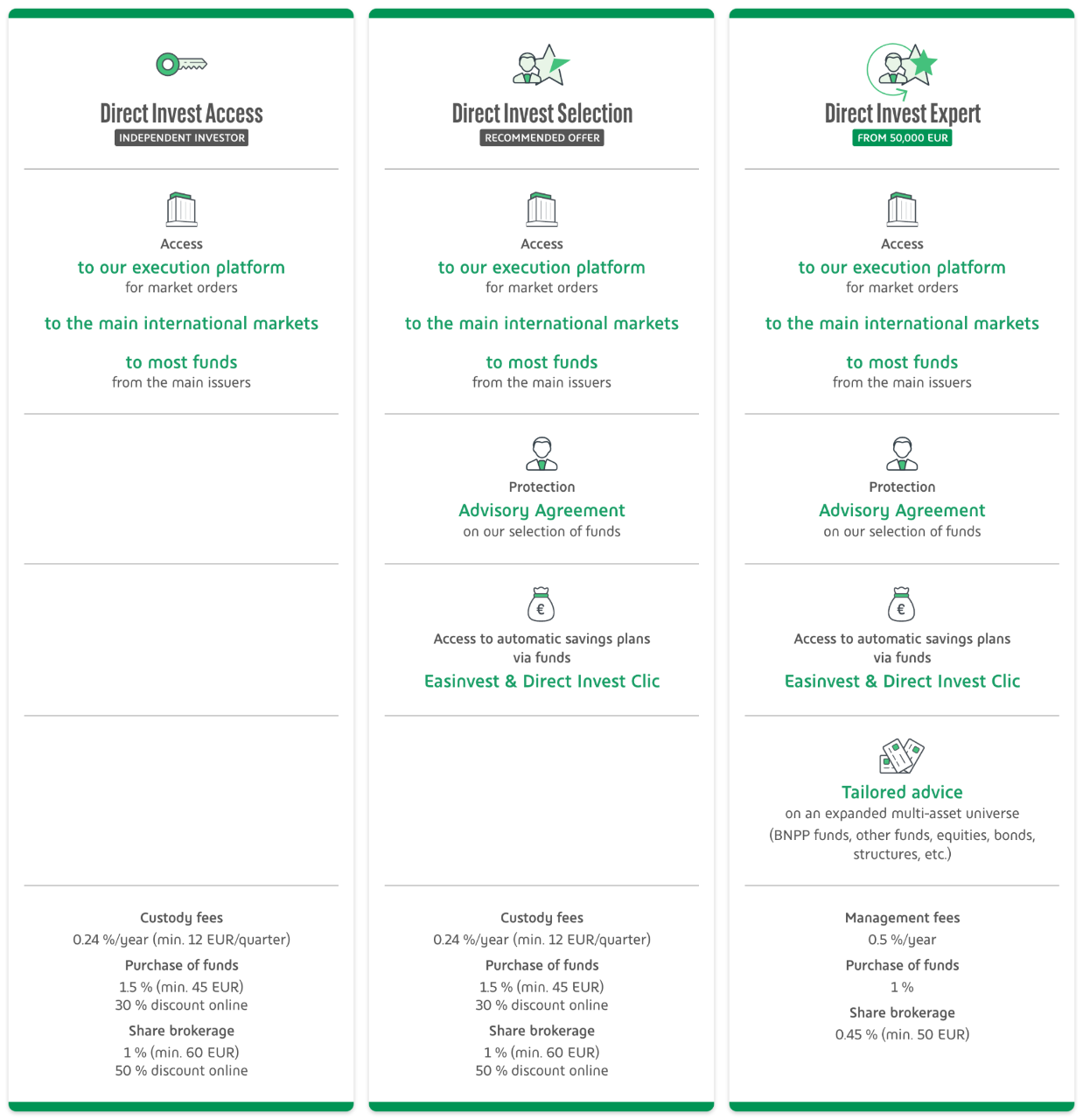

Direct Invest Access

Build and manage your securities portfolio on your own terms.

With our Direct Invest Access service, you have easy access to a wide array of financial products. You can place stock market orders autonomously via a secure platform and access comprehensive financial information.